Investing in the financial market can sometimes feel like sailing through unpredictable seas, especially during times of market stress and volatility. The waves of market uncertainty can make even the most seasoned investors uneasy, or at times even seasick. 2023 has been a time of turbulent markets. The graph below displays the year-to-date investment growth of a 60% equity and 40% fixed income portfolio (as illustrated by the MSCI All Countries World Index for equity and the Bloomberg Intermediate US Government/Credit Bond Index for fixed income). The graph shows that even with choppy waters, this balanced portfolio has returned an impressive +11.4% year to date (as of 11/30/2023).

At Washington Trust Bank, we believe successful navigation of turbulent markets requires staying invested, building a diversified portfolio, staying resistant to the allure of market timing, and maintaining a steady course towards your long-term investment objectives.VP / Portfolio Manager Nicolas Reynolds, CIMA®

Diversification: Your investment ballast.

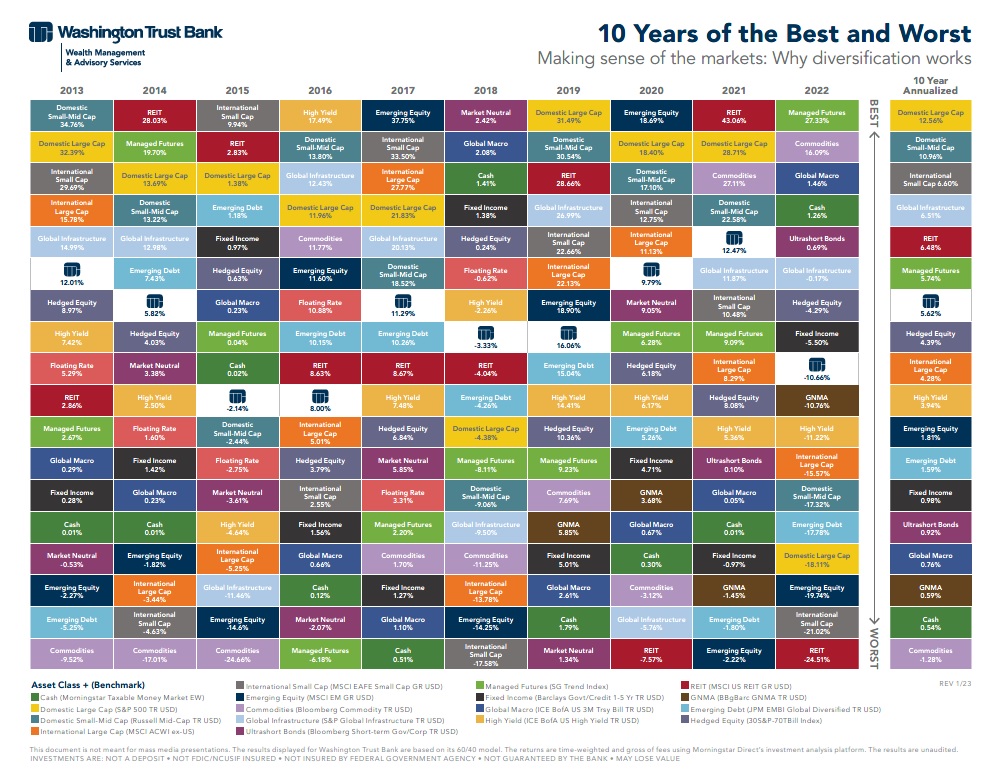

Diversification serves as the stabilizing ballast for your investment journey. Research has demonstrated the best approach is to diversify your investments across different asset classes. It reduces portfolio risk, enhances stability, and keeps your boat from capsizing. During market stress, certain sectors may face headwinds while others outperform with the wind filling their sails. We illustrate the importance and benefit of this “ballast” of diversification using this chart, which shows various asset classes’ performance over 10 years compared to a diversified 60% equity and 40% fixed income portfolio.

The chart helps illustrate that any one asset class’s performance is always changing, but a well-diversified portfolio navigates choppy seas with more stability over time. This approach will help ensure your journey is not just about weathering the storms, but about sailing through with stability and confidence.

The temptation of timing: a siren's song.

Market timing is a seductive idea – the belief that you can predict the market's highs and lows to maximize gains and minimize losses. However, history has shown that even the most sophisticated investors cannot consistently time the market to their advantage. Instead of being tricked by this siren's song, consider the long-term view, and stay the course. Successful investors recognize that time in the market is more important than trying to time the market. The chart below, as published by Blackrock, shows how a hypothetical $100,000 investment in stocks would have been affected by missing the market’s top performing days over the 20-year period from January 1, 2003, to December 31, 2022.

This clearly demonstrates that when you attempt to time the markets and miss only the top five performing days, it has a significant cost to your end market value; in this case $238,672 of lost returns over this period. If you miss more than the top 5 days, performance only gets worse and worse, thus highlighting the cost of failing at trying to time the market. The best strategy is to stay invested, even in high seas, and find a way to ride the waves to calmer waters.

Long-term vision: your north star.

In the midst of periodic market storms, it is crucial to keep your eyes on your long-term goals. As I discussed in a blog post earlier this year: goals-based investing can offer a superior approach. Define your investment objectives clearly, whether they are for retirement, a home purchase, or funding your children's education, or whatever is important to you. This long-term vision, or goal, should guide you as your North Star, steering your decisions and helping you navigate through the occasional rough seas when markets are volatile.

The financial news can be overwhelming in times of market stress. It is important to stay informed but avoid reacting impulsively to the noise of the financial media. To carry the analogies further, consider them the cacophonous seagulls looking for scraps of food wherever they can find it. Successful investors tune out that noise and remember that successful investing is a journey, not a destination. Stay invested and diversified for the long term, resist the allure of market timing, and keep your focus on your ultimate investment objectives. Like a skilled sailor on rough seas, your ability to weather the storms will determine the success of your investment voyage and help you reach the port of call with the ship still afloat.

Washington Trust Bank believes that the information used in this study was obtained from reliable sources, but we do not guarantee its accuracy. Neither the information nor any opinion expressed constitutes a solicitation for business or a recommendation of the purchase or sale of securities or commodities.

About the author

Nicolas Reynolds, CIMA®

VP / Portfolio Manager

Nick partners with Relationship Managers to bring disciplined, comprehensive, client-focused solutions as he works with the Portfolio Management team to structure client portfolios. In Coordination with the Relationship Manager and your existing legal and tax advisors, Nick works to ensure your investment portfolio is in alignment with your total wealth picture and structured to address your unique circumstances.

Internally, Nick also participates in strategy decisions with other members of the Portfolio Management Group to develop investment research and recommendations for our clients.