Soundbite.

The November Employment Situation report showed mixed results as job creation grew but the number of people employed fell.

-

Jobs increased 227,00 and revisions to the previous two months added another 56,000 jobs.

-

The number of people employed fell by 355,000 and the Labor Force Participation Rate fell from 62.6% to 62.5%.

-

The unemployment rate rose from 4.1% to 4.2%

November's results will not change the Federal Reserve's strategy towards interest rates. The Federal Reserve is still expected to lower its overnight borrowing rate by another 0.25%.

Establishment survey.

-

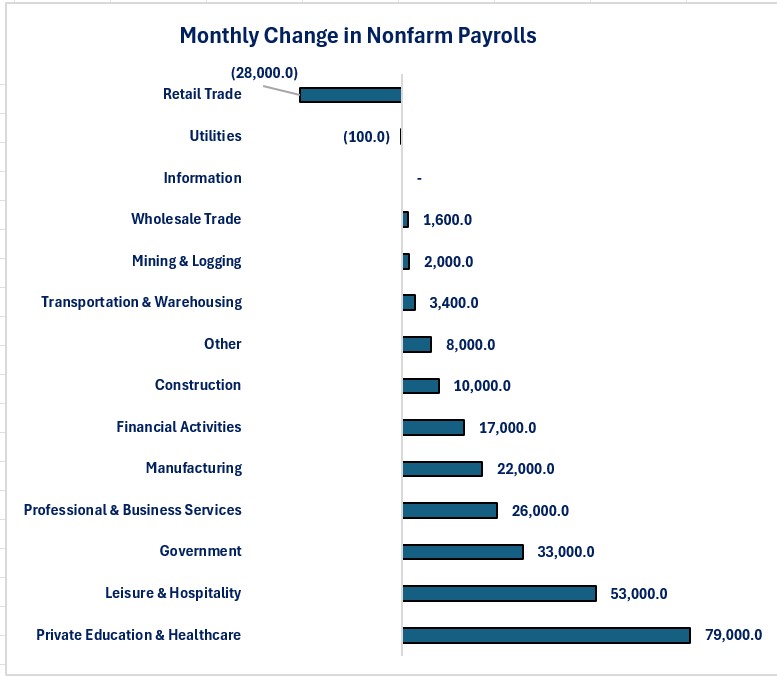

The Private Education & Healthcare sector led the way with the strongest jobs growth.

-

The Retail Sales and Utilities sectors lost jobs.

-

-

Growth in jobs remains concentrated in a few industries.

-

The top three industry sectors accounted for 73% of total jobs growth

-

-

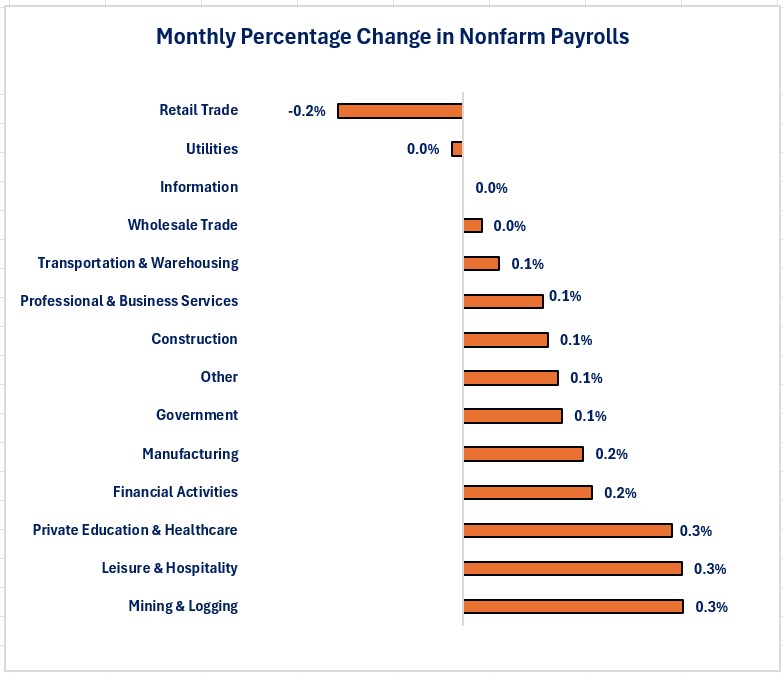

On a growth basis, the Private Education & Healthcare, Leisure & Hospitality and Mining & Logging sectors had the strongest growth rates and Retail Sales had the weakest.

-

The Information sector experienced the strongest year-over-year growth in average monthly earnings while Transportation & Warehousing experienced the weakest growth.

-

On a dollar basis, the Information sector also saw the strongest year-over-year dollar growth but, Retail Sales experienced the weakest dollar growth.

-

The difference in dollar growth between the strongest and weakest industry sectors was $94.34 per month.

-

The Information sectors dollar growth was 6.8 times more than the Retail sector.

-

This is another illustration of the different experiences different workers may be having when it comes to financial stress.

-

It is far harder to deal with increases in prices when your monthly wage increased by $16.11 per month compared to someone who experienced a $110.45 monthly increase.

-

-

-

Hourly employees saw a slight additional increase in wages as the average work week increased from 34.2 hour to 34.3 hours.

Household survey.

-

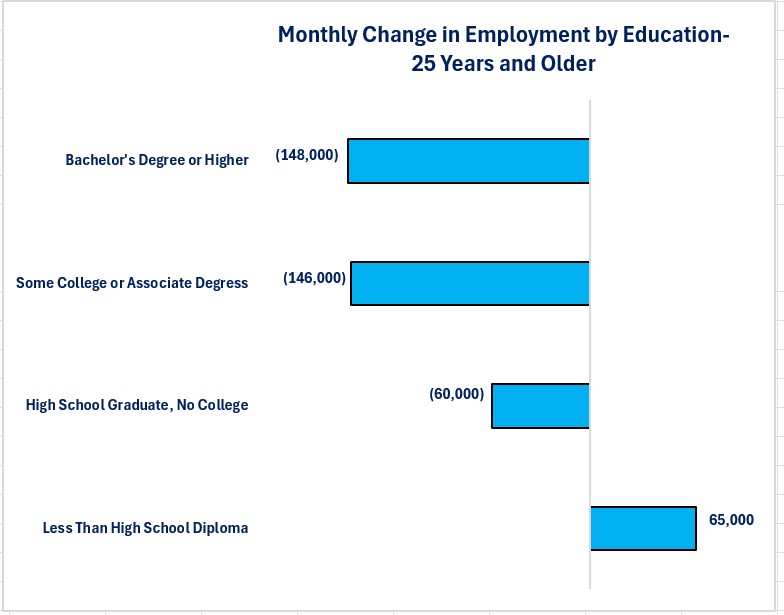

Examining employment by level of education showed that all levels of education, except those with less than a high school diploma fell and those with a Bachelor's degree or higher experienced the biggest loss of employment.

-

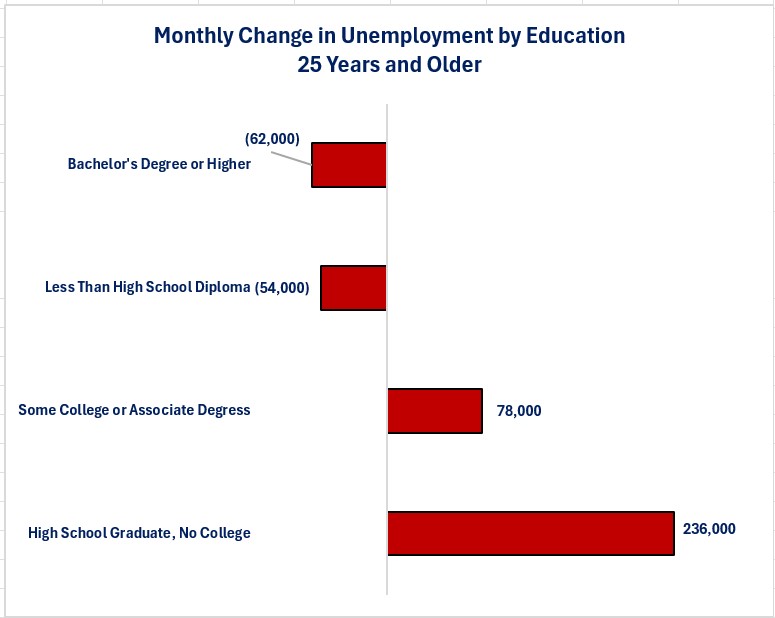

It may seem odd that two categories that experienced losses in employment showed declines in unemployment. This is because, unless someone who lost a job was actively seeking another job, they would not be counted as unemployed.

-

The reduction in unemployment levels for two of the education categories indicates that people in these categories dropped out of the labor force.

-

The number of people not in the labor force increased by 368,000. This is a combination of people who lost jobs in November but did not actively seek new jobs yet and people who have been looking for employment and have stopped looking.

-

-

The unemployment rate rose from 4.1% to 4.2%

-

The Labor Force Participation Rate fell from 62.6% to 62.5%

-

The number of people working multiple jobs rose by 275,000

-

The average duration of unemployment rose from 22.9 weeks to 23.7 weeks.

-

The percentage of people who have been unemployed 27 weeks or more rose from 22.9% to 23.2%.

Conclusions.

- The rebound in jobs growth in November reflected some of the unwinding of the distortions from October's report.

-

Remember, October's report was distorted by the hurricanes and Boeing strike.

-

-

Averaging October and November's jobs creation gives us an average of 132,000 jobs per month.

-

This is a slowing from the rest of the year but still positive.

-

-

The data continues to show signs of stress beneath the headlines.

-

The continued rise in number of people working multiple jobs needs to be monitored.

-

-

November's Employment Situation report does not change the Federal Reserve's strategy for interest rates.

-

Forecasts are still for a 0.25% reduction at this month's Federal Reserve policy meeting.

-

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.