Soundbite.

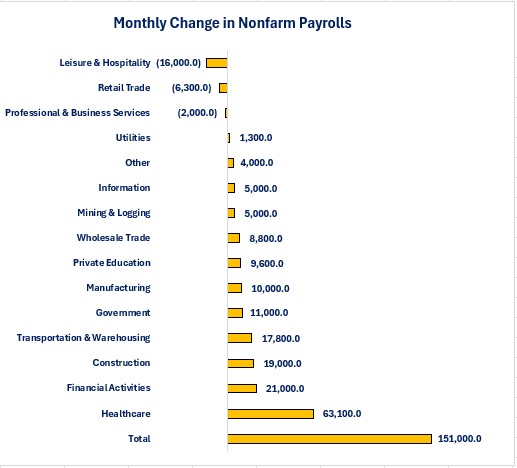

After ADP reported weaker than expected jobs growth earlier in the week, many started worrying that the nation was going to show weak jobs growth in February. That scare proved false as the Bureau of Labor Statistics (BLS) reported solid jobs growth of 151,000 in February. This was higher than the 125,000 growth seen in January. The top four industries for growth (Healthcare, Financial Activities, Construction, and Transportation & Warehousing) accounted for 80% of the jobs growth in February. Other information:

-

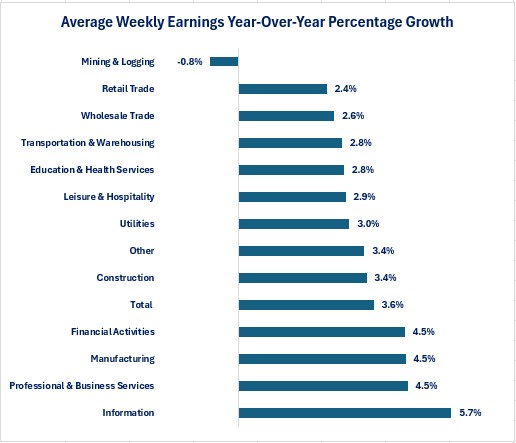

Average month wages grew 3.6% year-over-year.

-

The unemployment rate rose from 4.0% to 4.1%.

-

The labor force fell 385,000.

-

The Labor Force Participation rate fell from 62.6% to 62.4%.

Establishment survey.

-

The Healthcare industry experienced the largest growth in jobs while Leisure & Hospitality had the lowest.

-

Three industries lost jobs

-

Leisure & Hospitality

-

Retail Trade

-

Professional & Business Services

-

-

The top four industries (Healthcare, Financial Activities, Construction, and Transportation & Warehousing) accounted for 80% of total jobs growth.

-

Although the total Government sector showed essentially no change (.05% growth) the Federal Government sector showed a loss of 10,200 jobs.

-

Federal employees excluding the Post Office lost 6,700 jobs.

-

The Post Office lost 3.500 jobs.

-

This is the start of the layoffs that are occurring at the Federal level.

-

-

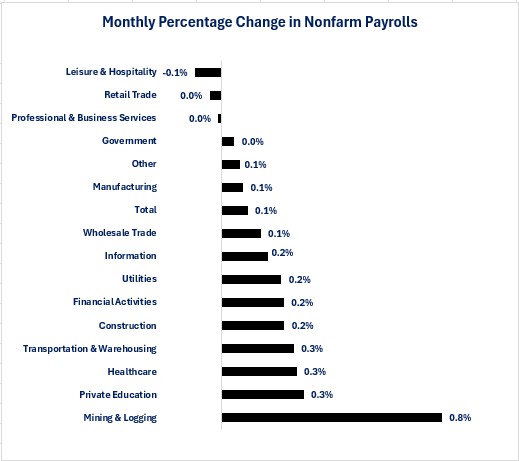

The Mining & Logging industry experienced the strongest monthly percentage growth while Leisure & Hospitality had the lowest.

-

The Information industry experienced the fastest year-over-year percentage growth while the Mining & Logging industry saw wage growth decline.

-

The gap in average monthly wage between the highest paying industry (Utilities) and the lowest paying industry (Retail Trade) grew to $1,457.57 per month from $1,411.20 per month in January.

-

Employees in the Utilities industry earn almost three times the monthly salary as an employee in the Leisure & Hospitality industry.

-

Hourly employees did not receive any additional income from increased hours worked as the average work week remained at 34.1 hours.

-

-

Average hours worked have steadily declined since the peak in April 2020 (35.0 hours).

-

Employers appear to still be reluctant to eliminate jobs and are reducing hours for all employees instead.

-

Household survey.

The Household Survey showed far different results than the Establishment Survey. The Household Survey showed that the number of people employed fell 588,000.

-

The unemployment rate rose from 4.0% to 4.1%

The labor force fell 385,000.

-

The Labor Force Participation Rate fell from 62.6% to 62.4%.

- The average duration of unemployment fell from 22.0 weeks to 21.3 weeks.

-

The percentage of people unemployed for 27 weeks or more fell from 21.1% to 20.9%

-

The number of people working multiple jobs rose 96,000 to a new record high.

-

The percentage of the total employed that are working multiple jobs rose from 5.2% to 5.4%.

-

Conclusions.

- Despite a scare from the ADP version of nonfarm payrolls, the official nonfarm payrolls report showed solid jobs growth.

-

The nation continues to create jobs which results in more income being created.

-

-

Employees may be pleased with a 3.6% year-over-year growth in wages but this will give no comfort to the Federal Reserve.

-

The Federal Reserve believes wage growth needs to be 3% or lower to support an inflation rate closer to 2%.

-

-

Although jobs growth was solid, it remains concentrated since the top four industries for growth accounted for 80% of total jobs growth.

-

The nonfarm payroll report will do nothing to motivate the Federal Reserve to lower interest rates.

-

At this time, the Federal Reserve remains on hold with regards to monetary policy.

-

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.