Soundbite.

The US economy created jobs at a faster pace than expected by economists surveyed by Bloomberg. The consensus forecast was for an additional 164,000 jobs to be created. Actual jobs created were 256,000. Growth remained concentrated as four industries accounted for 74% of total jobs growth. Wage growth slowed from a 4% year-over-year pace in November to 3.6% in December. People with less than a high school education experienced the biggest increase in employment (+170,000) while people with a bachelor's degree or higher experienced a 70,000 decrease in employment. With inflation still above the 2% target level and jobs creation still strong, it is doubtful that the Federal Reserve will lower interest rates at their next meeting.

Establishment survey.

-

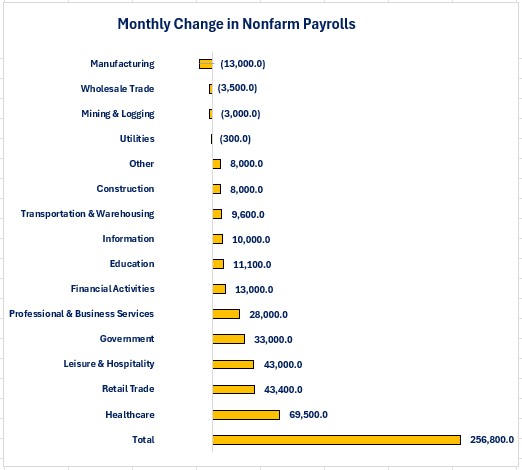

Four industries accounted for 74% of total jobs growth

-

Healthcare = 69,500

-

Retail Trade = 43,400

-

Leisure & Hospitality = 43,000

-

Government = 33,000

-

-

Four industries lost jobs

-

Manufacturing = (13,000)

-

Wholesale Trade = (3,500)

-

Mining & Logging = (3,000)

-

Utilities = 300

-

Average Weekly Earnings

-

The Information sector experienced the highest percentage increase in wages (5.9%) as well as the highest dollar increase ($105.52 per week).

-

The Mining & Logging industry experienced the smallest wage growth (0.2%) and the smallest weekly dollar growth ($3.52).

Additional Establishment Survey Data

-

Hourly employees hoping for more income via a longer work week were disappointed.

-

The average work week was 34.3 hours.

-

The average work week has remained unchanged for five consecutive months.

-

-

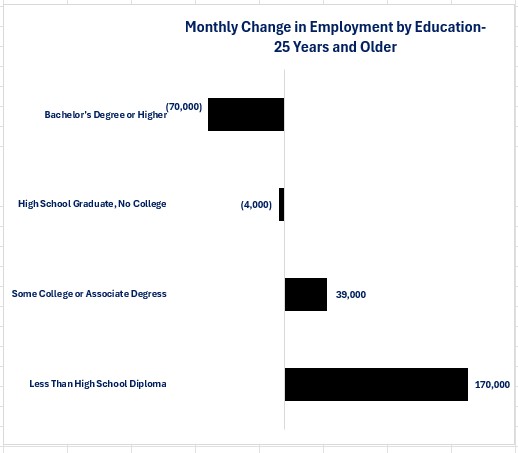

Even though the total employment level rose, it was primarily concentrated in people with less education.

-

Employed people with less than a high school education rose 170,000

-

Employed people with a bachelor's degree or higher fell 70,000

-

-

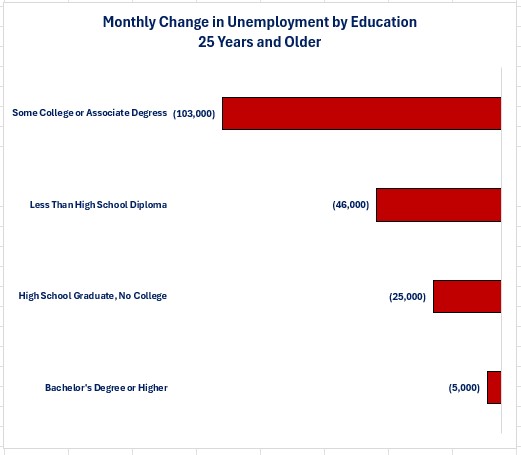

All levels of educational attainment experienced a decline in the level of unemployment.

-

Those with some college or associate's degree saw the biggest decline in unemployment and those with a bachelor's degree or higher experienced the lowest decline.

-

-

You may wonder how the level of employment in two education categories fell and yet the level of unemployment fell for all education categories. Intuitively, you would think that the level of unemployment should have risen for those education categories that experienced a decline in employment.

-

Remember, you have to be actively seeking a job to be considered unemployed.

-

This implies that, since 170,000 people with a bachelor's degree or higher were no longer employed but the level of unemployment actually declined, then these people either retired or did not start looking for new job yet.

-

-

-

The Labor Force increased 243,000.

-

The Labor Force Participation Rate was unchanged at 62.5%.

-

The Unemployment Rate rose from 4.1% to 4.2%

-

The number of people working part-time due to slack business conditions fell 258,000 but, the number of people who could only find part-time work rose 111,000.

-

The number of people working multiple jobs fell 99,000.

-

The average duration of unemployment rose from 23.6 weeks to 23.7 weeks.

-

The percentage of people that have been unemployed for 27 weeks or more fell from 23.1% to 22.4%.

Conclusions.

-

The nation continues to create jobs at a steady pace.

-

Although jobs growth remains solid, it also remains concentrated in a few industries.

-

-

We have to view the current data with a bit of caution because the Bureau of Labor Statistics will be making it annual revisions with next month's report.

-

The jobs report will most likely be further support for those Federal Reserve members who believe that interest rate reductions should be paused.

-

With inflation still above the Federal Reserve's 2% target and jobs growth remaining solid, the argument can be made that the economy does not need further stimulus via interest rate reductions.

-

Add in the uncertainty of what fiscal policy will be once President-elect Trump takes office; it is most likely that the Federal Reserve will not lower interest rates at its next meeting as it waits to assess further economic data and fiscal policy developments.

-

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.