Perspectives

- The data is as of 7/31/24

- The source is the NFIB Small Business Optimism survey data.

- The survey results are reported on a net basis.

- That means that the percentage of negative responses is subtracted from the percentage of positive responses.

- An example: if 60% of responses were positive and 40% were negative, the net percentage that would be reported would be 20%. The opposite result would be reported if 40% of responses were positive and 60% were negative. That would give a result of -20%.

Today's Perspectives section will examine the following categories:

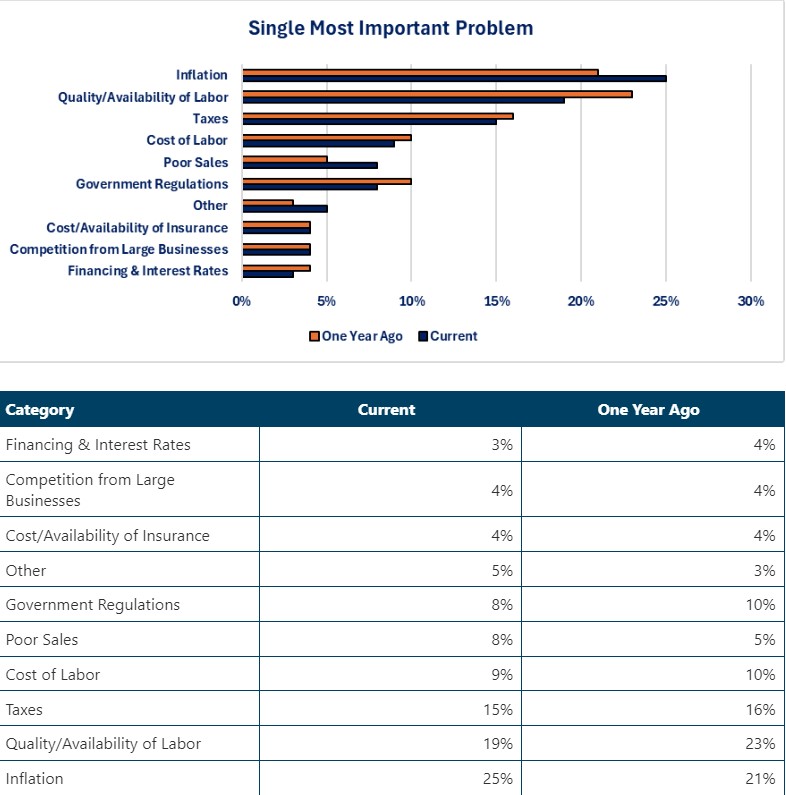

- Single most important problem (this category is not reported on a net basis)

- Sentiment

- Change in optimism

- Change in uncertainty

- Outlook

- Expansion in the next three months

- General business conditions six months from now

- Financial

- Actual earnings changes over the prior three months

- Actual sales changes over the prior three months

- Expected sales changes over the next three months

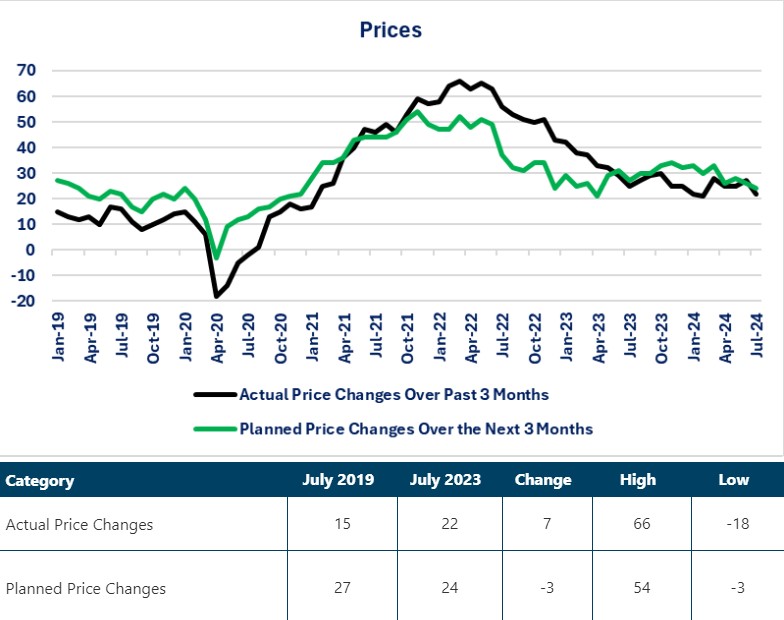

- Prices

- Actual price changes over the past three months

- Planned price changes over the next three months

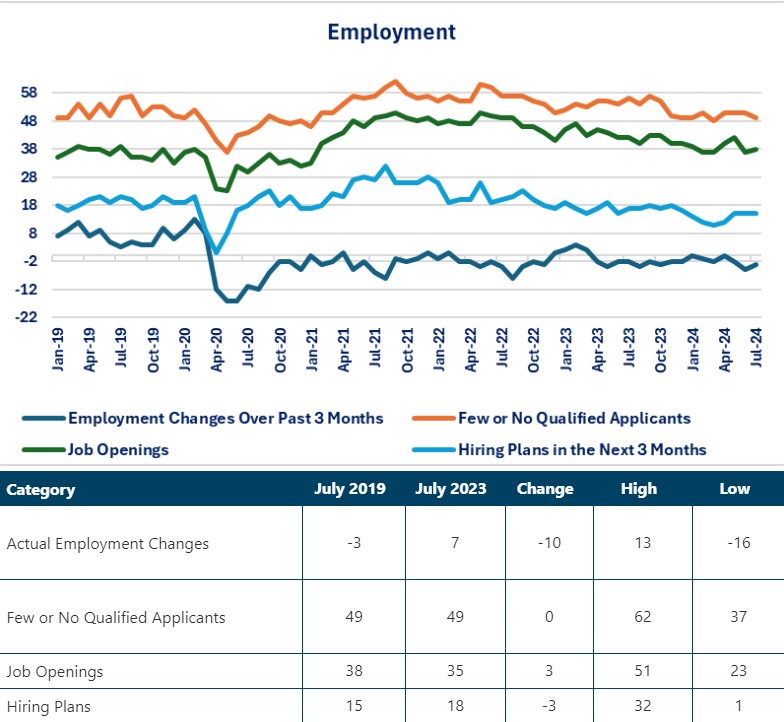

- Employment

- Actual employment changes over the past three months

- Change in job openings

- Change in few or no qualified applicants

- Change in hiring plans over the next three months

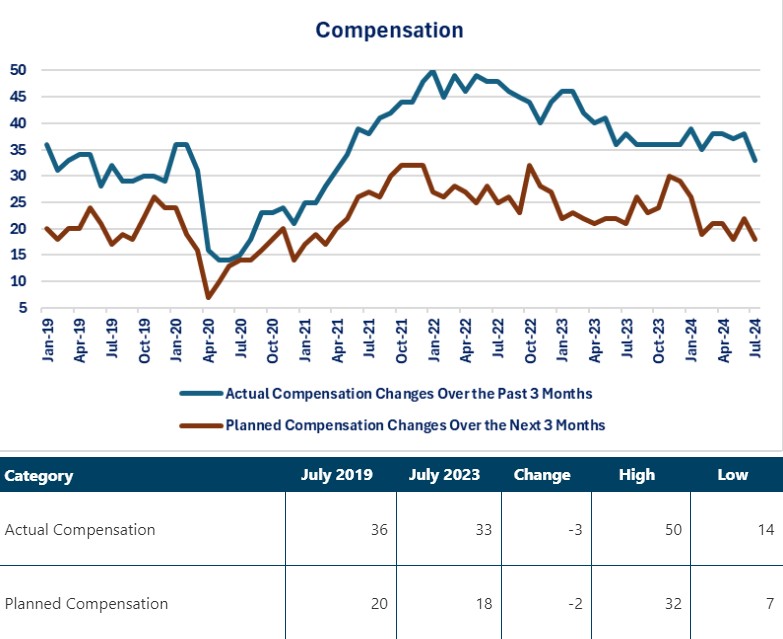

- Compensation

- Actual compensation changes over the past three months

- Planned compensation changes over the next three months.

Summary

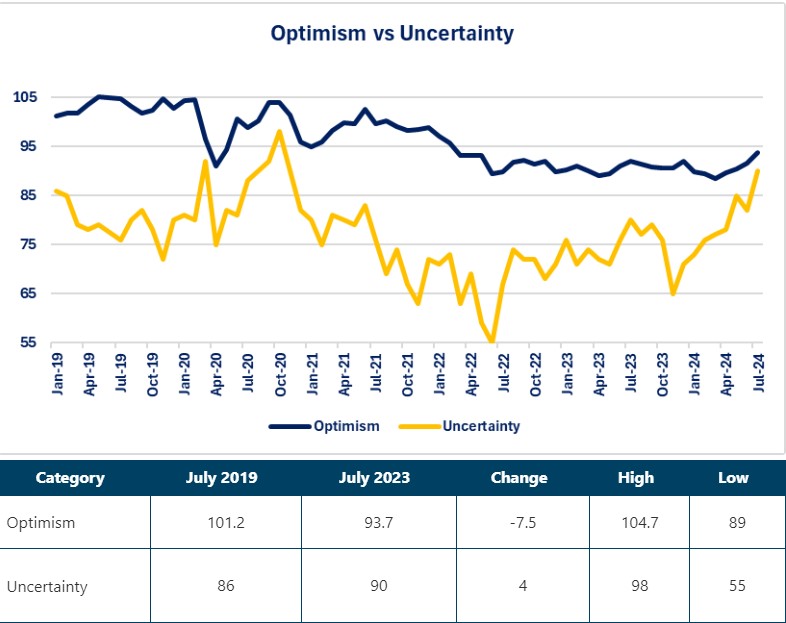

- Small business owners are growing more optimistic overall but they are also growing more uncertain.

- Contrary to the portrayal by many media source and economist that the inflation problem has been solved, a growing percentage of small business owners say that inflation is their most important problem.

- The outlook for general business conditions is steadily improving.

- Even though small business owners are becoming more optimistic, and their outlook is improving, it is not translating into improved earnings or more hiring.

- A lack of qualified applicants continues to be an issue from the hiring perspective.

- Rising costs and weaker sales are driving the earnings challenges.

Observations

- Inflation was the single most important problem in July compared to quality/availability of labor being the top problem a year ago.

- Despite the headline reports of soaring insurance costs and high borrowing costs, those two categories rank low for small business owners when it comes to identifying their single most important problem.

- Small business owners are slowly becoming more optimistic, although still below levels that existed July 2019.

- Even though they are becoming more optimistic, their uncertainty is growing. The current uncertainty level is far closer to the high compared to the low and is four percentage points higher than July 2019.

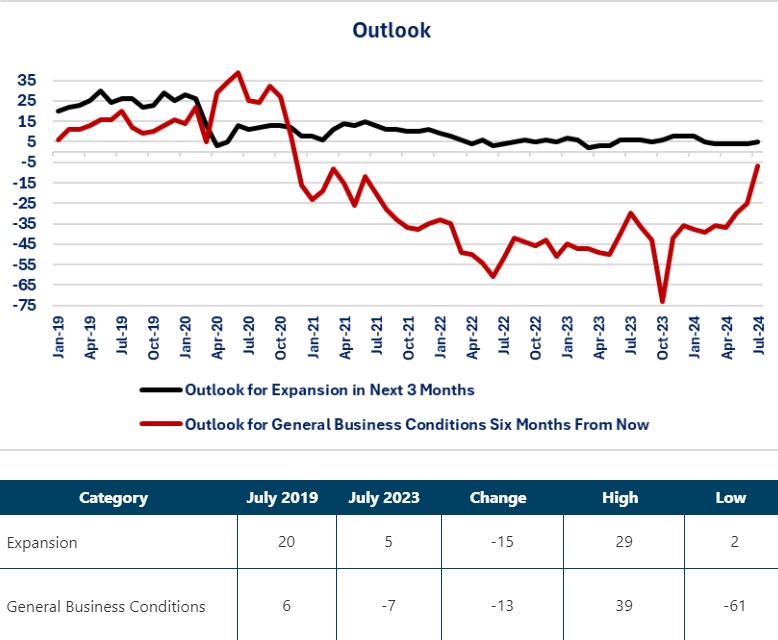

- Small business owners do not appear to be in the mood for expansion as the results have hovered in a range since April 2022.

- Owners report that business conditions and the political environment are the primary drivers affecting their outlook for expansion.

- Even though owners are not in the mood for expansion, they are becoming more optimistic on their outlook for general business conditions six months from now.

- No details were provided for this category but perhaps their outlook has improved because they believe interest rates will be lower and the elections will be over.

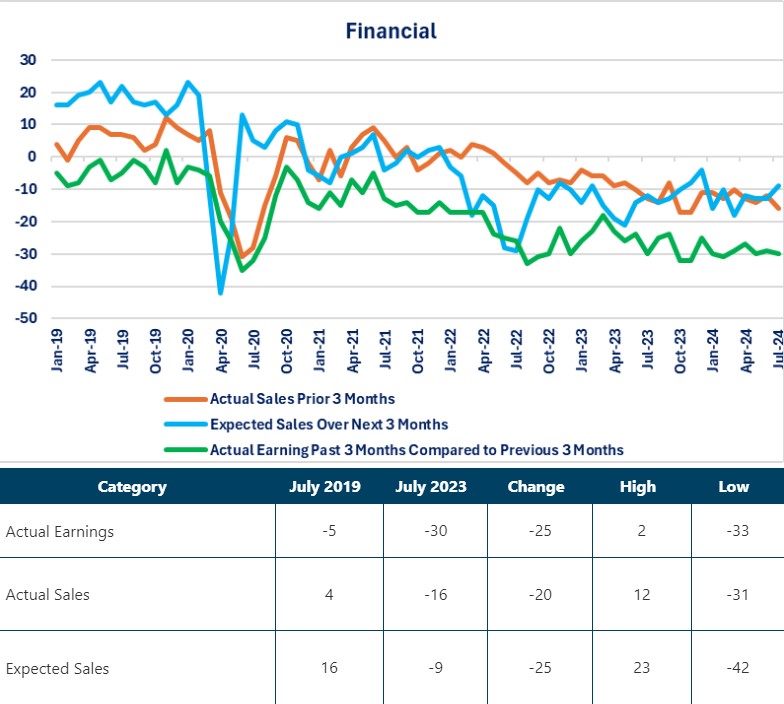

- The overall trend for sales has been slowly declining since the second half of 2021.

- Declining sales are one of two major factors (along with rising costs) identified by small business owners as the reason for their declining earnings.

- Expectations for improving sales ticked up in July compared to June. One month does not start a trend but is worth monitoring.

- The challenge facing small business owners is that their costs are still a problem, and they have not been able to fully pass those cost increases through to the price of their final product (as evidenced by the declining trend for earnings).

- The trend for actual price changes has steadily been decreasing since the Federal Reserve began raising interest rates at the beginning of 2022.

- Planned price changes are now in sync with actual price changes when it comes to trends.

- Looking at the graph below, there is no clear trend for the four employment categories. All are hovering within ranges.

- Changes in employment remain slightly negative on a net basis but are not getting worse.

- A lack of qualified help is off its highs but is at the same level that existed July 2019.

- Hiring plans and job openings remain within ranges.

- The percentage of small business owners raising compensation over the past three months declined in July. The same is true for those planning to raise compensation.

- This is most likely due to their financial conditions deteriorating (i.e., declining sales and earnings).

Closing Thoughts

- Contrary to all of the media coverage touting how inflation is coming under control and the Federal Reserve is going to lower interest rates in September, a growing percentage of small business owners are saying that inflation is their most important problem. That indicates that inflation is not under control for their business.

- Higher costs were the top reason given for lower earnings. Higher costs include labor, materials, financing, taxes and regulatory costs.

- Despite the headlines of soaring cost of insurance and high interest rates, those two categories rank low for small business when it comes to ranking their most important problem.

- That does not mean that they are not a problem, simply that they are not the most important problem.

- One area that bears monitoring closely is the trends for small business finances.

- The percentage of small business owners saying that poor sales are their most important problem increased from 5% to 8%. Not a huge change but worth monitoring to see if it continues to rise.

- The net percentage of small business owners who are reporting declining sales and earnings increased from June to July and has not shown much improvement since October 2023.

- Owners report higher costs, and slower sales are the primary driver for lower earnings.

- If you examine the two graphs related to prices, they look remarkably like a graph of inflation. That should not be surprising since inflation is measuring the change in price in goods and services. To me it highlights that small business prices appear very similar to overall business pricing.

- This highlights a topic I have discussed before: small business are price “takers” not price “makers”. What that means is that few small businesses have such a unique niche in the market that they can establish (i.e. “make”) the price of their goods and services. Instead, they follow (i.e. “take”) the prices that big businesses establish.

- Since a small business owner usually has to accept the price being set by big businesses for their goods and services but does not normally have bargaining power-via multiple supply sources or large quantity order-to reduce with their suppliers, their earnings are usually hit faster than a big business.

- The pressure to raise compensation to attract or retain key employees appears to be easing based on the July survey results.

- That is still a relative improvement since the net number was 33. That means that 66.5% reported raising compensation compared to 33.5% who did not. That is clearly better than the 75% who were reporting compensation increases as of February 2022, but it is still more than 50%.

- As always, I will caution that surveys give us a composite picture. Some small business owners are experiencing far worse conditions than what the survey results show while others are experiencing far better conditions.

- This highlights the mantra that I have stated on multiple occasions: believe what you are experiencing not what the media is saying if the two do not match.

Economic Data

|

Data |

Time Period Being Reported |

Current |

Previous |

Comments |

|

8/13/24 |

|

|

|

|

|

NFIB Small Business Optimism Index |

July |

93.7 |

91.5 |

Four of the sub-indices rose, four were unchanged and two declined. |

|

Producer Price Index (PPI) Year-Over-Year Change |

July |

2.2% |

2.7% |

A decline in service prices helped bring down the rate of growth. |

|

July |

0.1% |

0.2% |

Similar improvement for the monthly data. |

|

Core PPI Year-Over-Year Change |

July |

2.4% |

2.7% |

Similar declines for the core index as the headline index. |

|

July |

0.0% |

0.2% |

Declines in the price of services offset increase in the price of goods. |

|

8/14/24 |

|

|

|

|

|

MBA Mortgage Applications |

8/9/24 |

16.8% |

6.9% |

This is the biggest weekly increase since January 2023. The majority of the increase was a surge in applications to refinance. |

|

8/9/24 |

3.0% |

-4.0% |

Lower interest rates brought buyers back into the market. |

|

8/9/24 |

35.0% |

0.2% |

The sharp drop in mortgage rates triggered a wave of refinancing activity. |

|

Consumer Price Index (CPI) Year-Over-Year Change |

July |

2.9% |

3.0% |

Continued declines in energy prices helped slow the pace of inflation growth. |

|

July |

0.2% |

-0.1% |

On a monthly basis, prices rebounded from June. |

|

Core CPI Year-Over-year Change |

July |

3.2% |

3.3% |

Still way above the 2% Federal Reserve target. |

|

July |

0.2% |

0.1% |

Core CPI needs to average 0.1% for the rest of the year to get close to the Federal Reserve's target. |

|

8/15/24 |

|

|

|

|

|

Initial Jobless Claims |

8/10/24 |

227,000 |

234,000 |

Despite all of the worries after last Friday's employment report, initial claims improved as claims fell 7,000 from last week. |

|

Continuing Jobless Claims |

8/3/24 |

1,864,000 |

1,871,000 |

Continuing claims actually fell more than the 7,000 reported decline because last week's number was revised lower by 4,000. |

|

Business Inventories |

June |

0.3% |

0.5% |

Inventories rose 0.9% at retailers, 0.2% at wholesalers and remained unchanged at manufacturers. |

|

Export Prices Year-Over-Year Change |

July |

1.4% |

1.0% |

Prices for corn, wheat, fruit, soybeans and meat fell while prices for industrial supplies and materials; automotive vehicles; consumer goods; and nonagricultural foods rose. |

|

Import Prices Year-Over-Year Change |

July |

1.6% |

1.5% |

Prices for foods, feeds, and beverages; automotive vehicles; and capital goods rose while prices for consumer goods and for nonfuel industrial supplies and materials fell. |

|

New York Federal Reserve Manufacturing Activity Index |

August |

-4.7 |

-6.6 |

This is the highest level in six months for the index. To keep things in perspective, activity is still negative. |

|

Philadelphia Federal Reserve Manufacturing Index |

August |

-7 |

13.9 |

This is the first decline in activity since January. |

|

Retail Sales Year-Over-Year Change |

July |

2.7% |

2.0% |

A 5.2% year-over-year increase in the Electronics & Appliance Stores categories led the way for increases. |

|

July |

1.0% |

-0.2% |

A 4.0% increase in auto sales reversed the 3.9% decline in June caused by a software glitch. |

|

Industrial Production Year-Over-Year Change |

July |

-0.2% |

1.1% |

Hurricane Beryl impacted the results. |

|

July |

-0.6% |

0.3% |

Hurricane Beryl resulted in shutdowns for many utilities in the South region (Houston). |

|

July |

-0.3% |

0.0% |

This was the first decline since April. |

|

National Association of Homebuilders Housing Market Index |

August |

39 |

41 |

A continued pessimistic outlook from builders may impact their willingness to build new homes going forward. |

|

8/16/24 |

|

|

|

|

|

Housing Starts Monthly Change |

July |

-6.8% |

3.0% |

All of the decline was in single family homes. Starts for single family homes fell 14.1% while starts for multi-family rose 11.7%. |

|

Building Permits |

July |

-4.0% |

3.9% |

Permit activity for future building saw opposite results from housing starts. Permits for single family homes fell 0.1% while permits for multi-family fell 12.4%. |

|

University of Michigan Consumer Sentiment Index |

August |

67.8 |

66.4 |

Consumer sentiment improved, driven by a more optimistic outlook for the future. |

|

August |

60.9 |

62.7 |

Consumers continue to feel negatively about their current situation. |

|

August |

72.1 |

68.8 |

Although negative about their current situation, consumers are more optimistic about the future. |

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.