Last week we examined how business owners assessed their business's current conditions. This week we will examine their outlook for six months from now. Since the survey was as of 11/17/24, we might gain insight into their outlook after the elections were completed.

Soundbite.

Business owners appear to be more positive in their outlook for the future compared to their current assessment of business conditions as the percentage of business owners believing their business's performance will be below average or poor is less than the percentage who currently rate their performance as below average or poor. Even though they are more optimistic, that is not translating into expectations to hire more people, increase hours worked or to open new locations. The one area of caution is that business owners expect continued price increases from their suppliers. The challenge that business owners anticipate is the ability to full pass-through price increases. Similar to the last week's results for current assessment, the future expectations results show a smaller percentage of business owners expecting to increase prices compared to the percentage expecting to pay higher prices. . The results of the survey indicates business owners anticipate positive results going forward.

Disclosures.

-

Data is from the same Census Bureau Business Trends and Outlook Survey (BTOS) that was used to examine current conditions last week.

-

The most current data is the same as last week: 11/17/24.

-

Analysis will be broken into six categories examining the expected change in the category six months from now.

-

Company performance.

-

Demand for business's goods and services.

-

Delivery times.

-

Prices paid and charged.

-

Number and hours of paid employees.

-

Business activities.

-

-

When comparing current assessment versus future expectations, the current assessments data is from last week's newsletter.

Observations.

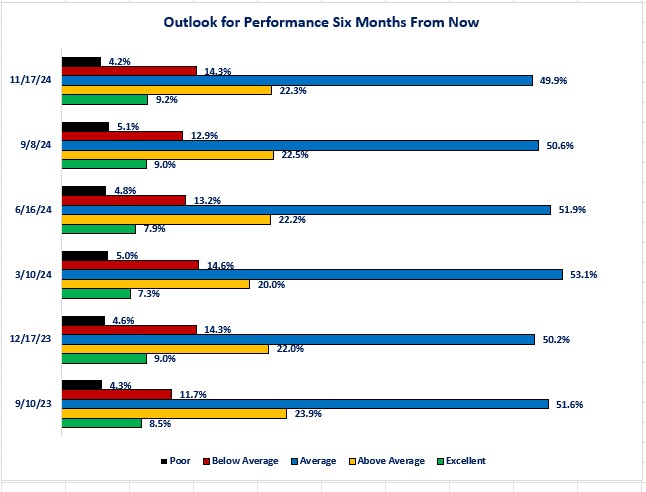

Let us start by examining future expectations for performance and compare it to their assessment of current performance.

Outlook for Performance Six Months From Now-

More business owners think their performance will be average compared to the current assessment of performance.

-

Last week's results showed 47.9% rated their performance as average.

-

This week's results show 51.6% expect average performance six months from now.

-

This was a result of the combination of the Below Average and Poor categories falling from a current percentage of 21.8% to a future expectations percentage of 16.0%.

-

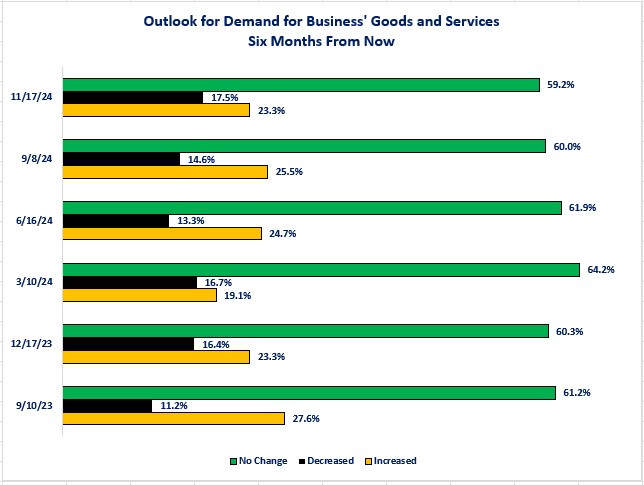

One of the reasons that businesses are more optimistic about future performance is because they are more optimistic about the future demand for their goods and services.

Outlook for Demand for Business's Goods and Services Six Months From Now- The percentage of business owners expecting an increase in demand rose from a current percentage of 10.9% to a future expectations percentage of 27.6%. On the flip side, the percentage of business owners expecting demand to decrease fell from a current level of 22.1% to a future assessment percentage of 11.7%.

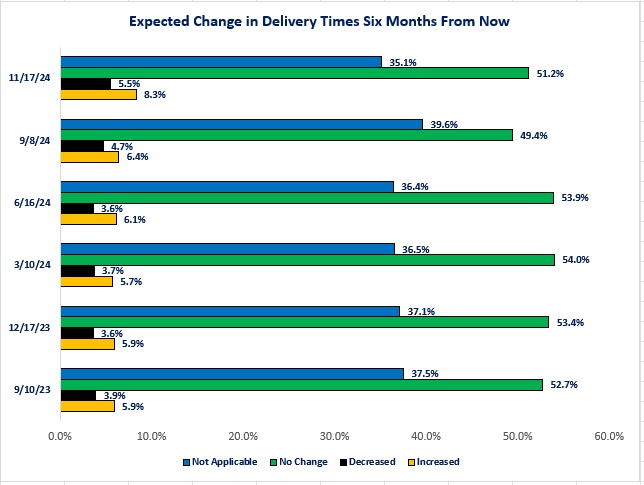

Now, let us examine their expectation for future delivery times. The last thing that we would want to see is businesses expecting increased demand but then facing longer delivery times to meet that demand.

Expected Change in Delivery Times Six Months From Now-

The interesting result is the percentage of business owners stating that delivery times were not applicable. This percentage grew from a current assessment percentage of 30.9% to a future expectations percentage of 37.5%. No detail is provided but, this appears to be a sign that more businesses don't expect a need for new inventory in six months.

-

Given the fact that a larger percentage of business owners expect increased demand for their goods and service in six months, we cannot attribute the lack of need for inventory to slowing sales.

-

The alternative explanation may be that businesses are currently stocking up on inventory due to anticipated higher demand or tariffs and thus, would not need more inventory in the future.

-

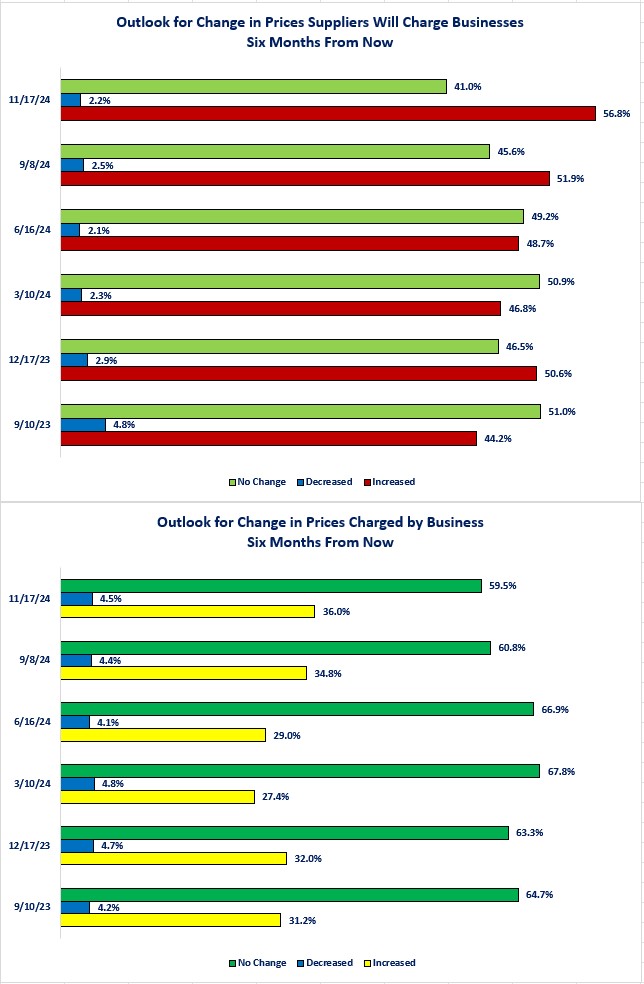

Outlook for Change in Prices Six Months From Now

-

Business owners are not optimistic about rising prices and their ability to pass those costs through to their end product.

-

The percentage expecting higher prices six months is 44.2% compared to the percentage currently experiencing higher prices at 28.2%.

-

Although a higher percentage of business owners expect to raise prices in six months (31.2%) compared to the percentage currently raising prices (9.1%) the percentage is still smaller than the percentage expecting their suppliers to charge them higher prices (44.2%).

-

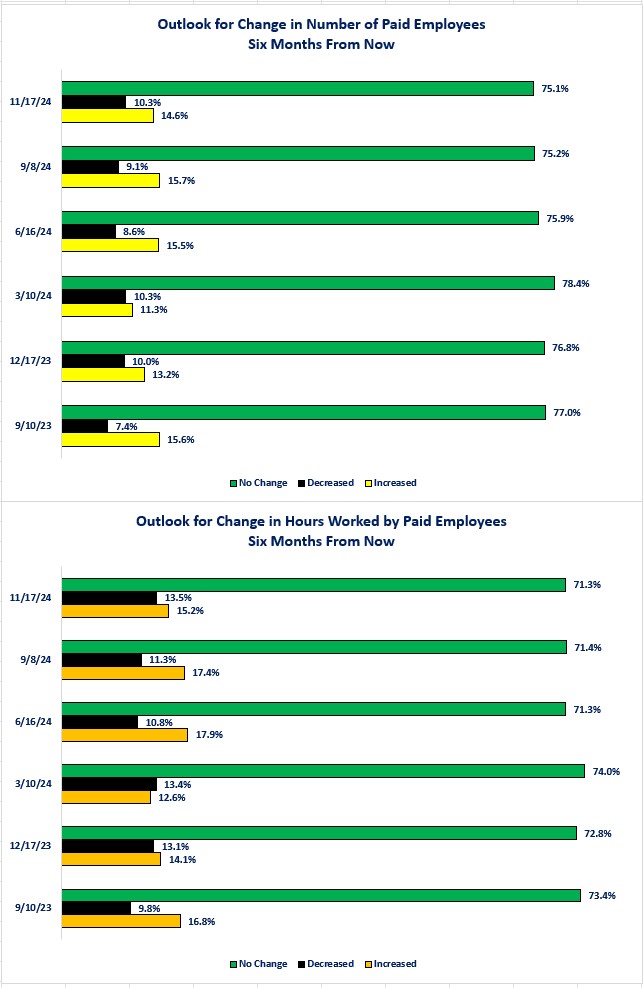

Outlook for Change in Paid Employees and Hours Six Months From Now

-

Business owners are not expecting to make any major changes to their paid employee base as 77% percent of the responses were for no changes. Similarly, 73.4% expect hours worked by paid employees to remain unchanged.

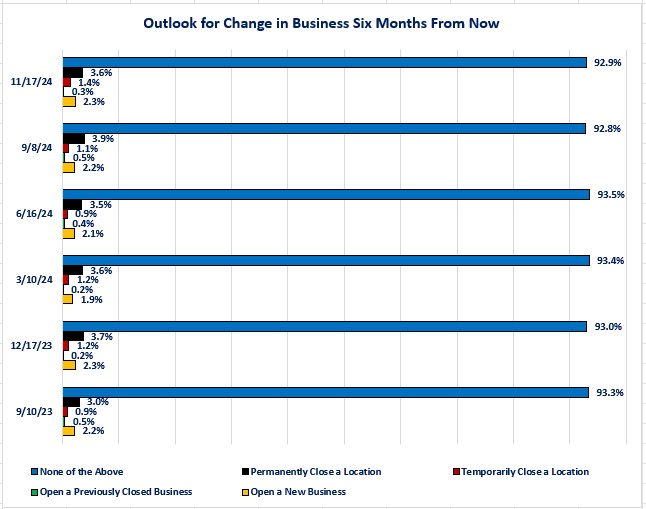

Outlook for Change in Business Six Months From Now

-

Business owners appear to be in a “steady as she goes” mindset as over 90% of respondents do not plan to open new locations or close existing locations. This has been true since the start of this survey.

Closing thoughts.

- Based on the BTOS results, business owners are generally more optimistic about the future compared to current conditions.

- The percentage expecting Below Average or Poor performance in six months is lower compared to their current assessment.

-

Even though a higher percentage of business owners expect demand for their goods and services to increase, they are not expecting to increase inventories as the percentage responding that delivery times are not applicable increased.

-

This implies that business owners may be stocking up now to avoid any problems with delivery times in six months.

-

If President-elect Trump actually carries out his threats of tariffs and deportation, the supply chain would be affected (i.e. price of imported products and potential labor shortage) in the transportation & warehousing industry.

-

Stocking up now is a risk-management strategy to manage the above risks.

-

-

-

Even though business owners are more optimistic about demand for their goods and services and their performance, they are not as optimistic about prices.

-

Similar to last week's results, a higher percentage of businesses are expecting higher prices from their suppliers compared to the percentage expecting to be able raise prices on their goods and services.

-

This could be another reason for stockpiling inventory now.

-

-

In general, small businesses will suffer more financial stress if their profit margins are hurt by the inability to fully pass on price increases.

-

Big corporations usually have a higher amount of cash reserves or capital to absorb reduced profit margins.

-

If profit margins remain under pressure, reduced hours or number of employees may become the choice to manage expenses.

-

-

-

For people seeking work, business owners are not sending an optimistic message.

-

Business owners are not expecting to increase the number of paid employees.

-

Current paid employees who may hope for more hours to help pay bills are not getting encouraging news either as the majority of business owners do not anticipate increasing hours worked for employees.

-

-

The fact that the majority of business owners do not anticipate adding employees or increasing hours worked implies that business owners are focusing on productivity.

-

Increased productivity helps a business owner control costs if they expect to pay more to their supplier but don't expect to be able to pass those costs through to their goods and services.

-

Since labor costs are a major expense for most businesses, increased productivity helps control the rise in labor costs.

-

The 3rd quarter GDP results support this theory. Spending on plant & equipment rose 10.2% while spending on intellectual property products rose 2.5%. That indicates businesses are investing both in new plants and equipment but also investing in software to improve productivity.

-

The week's results from the BTOS supports other economic data that shows the economy ending the year on solid footing. This week's results show that business owners anticipate positive results going forward.

-

What the future ultimately holds will remain uncertain until we see what policies and executive orders President-elect Trump and Congress enact and how business owners respond.

-

-

Economic data.

|

Economic Data |

Time Period |

Current Results |

Previous Results |

Comments |

|

12/16/24 |

|

|

|

|

|

New York Federal Reserve Manufacturing Index |

December |

0.20 |

31.20 |

Manufacturing activity in the New York region sharply decelerated in December. |

|

S&P-Global Purchasing Managers Index (PMI) |

December |

56.6 |

54.9 |

The increase in activity was driven by the services sector. |

|

December |

48.3 |

49.7 |

Even though overall activity increased, manufacturing activity decreased. |

|

December |

58.5 |

56.1 |

Activity in the services sector showed a solid increase. |

|

12/17/24 |

|

|

||

|

Retail Sales Year-Over-Year Change |

November |

3.8% |

2.6% |

Retail sales were powered by a 9.8% increase in non-store retailers. |

|

Industrial Production Monthly Change |

November |

-0.1% |

-0.4% |

The pace of decline in industrial production slowed compared to October. |

|

November |

+0.2% |

-0.7% |

Production in the manufacturing sector moved back into positive territory. |

|

NAHB Housing Market Index |

December |

46 |

46 |

No change from November. |

|

12/18/24 |

|

|

||

|

MBA Mortgage Applications Weekly Change |

12/13/24 |

-0.7% |

+5.4% |

Applications fell for the first time in six weeks. |

|

12/13/24 |

+1.4% |

-1.1% |

A rise in applications to purchase a house helped to offset the decline in applications to refinance. |

|

12/13/24 |

-2.6% |

+27.2% |

After a surge last week, applications to refinance fell as mortgage rates rose. |

|

Housing Starts Monthly Change |

November |

-1.8% |

-3.1% |

Single family starts rose 6.4% but multi-family starts fell 24.1%. |

|

Building Permits Monthly Change |

November |

+6.1% |

-0.4% |

Single family permits rose 0.1% while multi-family permits rose 22.1%. |

|

12/19/24 |

|

|

||

|

Initial Jobless Claims Weekly Change |

12/14/24 |

220,000 |

242,000 |

Initial claims continue to stay within a range of 200,000 to 250,000. |

|

Continuing Jobless Claims Weekly Change |

12/26/24 |

1,874,000 |

1,879,000 |

The 5,000 decline was better than reported as last week's number was revised down from 1,886,000 to 1,879,000. |

|

Real Gross Domestic Product (GDP)-Third Estimate |

3rd Quarter |

3.1% |

2.8% |

The final revision to 3rd quarter GDP showed a stronger economy than originally reported. An upward revision to consumer and government spending drove the upward revision. |

|

GDP Price Index |

3rd Quarter |

+1.9% |

+1.9% |

There was no revision to the GDP Price Index. |

|

Philadelphia Federal Reserve Manufacturing Index |

December |

-16.4 |

-5.5 |

Manufacturing activity fell even further in December. |

|

Kansas City Federal Reserve Manufacturing Index |

December |

-5.0 |

-4.0 |

Manufacturing activity continued to decline. |

|

Leading Index Monthly Change |

December |

+0.3% |

-0.4% |

The index moved into positive territory for the first time in over two years. |

|

Existing Home Sales Monthly Change |

November |

+4.8% |

+3.4% |

Existing home sales picked up in November as more inventory was available for sales. |

|

12/20/24 |

|

|

||

|

PCE Price Index Monthly Change |

November |

+.01% |

+0.2% |

The growth in headline PCE Price Index slowed in November. |

|

November |

+0.1% |

+0.3% |

The good news from the Federal Reserve's perspective is that the monthly growth for Core PCE slowed more than expected. |

|

PCE Price Index Year-Over-Year Change |

November |

2.4% |

+2.3% |

The headline PCE Price Index rose slightly from October's growth rate. |

|

November |

+2.8% |

+2.9% |

Year-over-year growth declined slightly in November. |

|

Personal Income Year-Over-Year Change |

November |

+5.3% |

+5.5% |

Income growth slowed slightly but remains strong. |

|

November |

+2.6% |

+2.9% |

Growth in Income after inflation and taxes also slowed slightly. |

|

Personal Spending Year-Over-Year Change |

November |

+5.5% |

+5.5% |

The growth in spending matched October's pace. |

|

November |

+2.9% |

+3.0% |

Spending after inflation slowed slightly. The growth rate of spending continues to outpace the growth rate of income. |

|

University of Michigan Consumer Sentiment Index |

December |

74.0 |

71.8 |

The increase was driven by a surge in optimism about current conditions. |

|

December |

75.1 |

63.9 |

Since the election, consumers have become much more optimistic about their current situation. |

|

December |

73.3 |

76.9 |

The trade-off is that they have become much less confident about what the future holds. |

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.