The uncertainty over the US tariff policy has given rise to fear and uncertainty over inflation. This week's Perspectives section examines what small businesses are currently experiencing and what they are expecting six months from now regarding the prices they are paying to produce their goods and services and the prices they are charging for their product.

Soundbite.

The good news for small businesses is that, on average, over 60% have experienced no changes to the prices that they pay. The good news for consumers is that over 80% of small businesses are not currently raising prices. The concerning news is that, over 35% of small business owners are currently experiencing price increases for the goods and services that they must buy while less than 20% are currently raising prices for the goods and services that they sell. That is a formula for decreased profit margins.

Since small businesses are a critical source of jobs and income creation, any threats to small business profitability and ultimately viability will affect economic growth.

Disclosures.

Data is from the Census Bureau's Business Outlook and Trends Survey (BTOS).

-

Data is as of 2/9/25.

Business size is broken down by the Census Bureau as follows:

-

1-4 employees

-

5-9 employees

-

10-19 employees

-

20-49 employees

-

50-99 employees

Survey topics being examined are:

-

Current change in prices paid by the business.

-

Expectations for change in prices that will be paid by the business six months from now.

-

Current change in prices charged to the customer.

-

Expected change in the prices charged to the customer six months from now.

Observations.

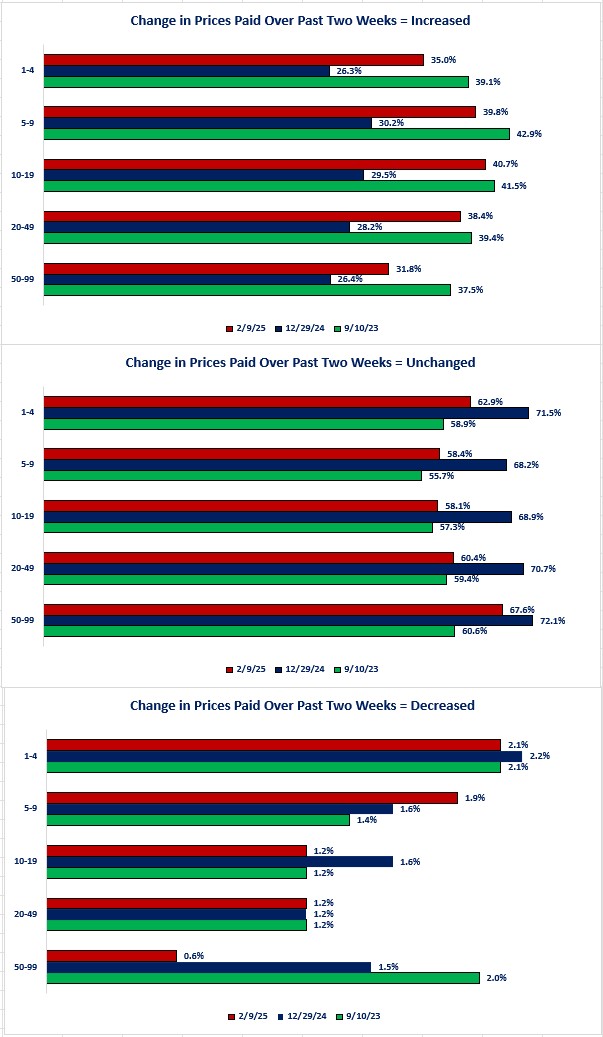

Let us start by examining what changes in prices paid by the business have occurred over the past two weeks.

The survey question is: "In the last two weeks, how did the prices this business pays for goods or services change?"

Change in Price Paid Over the Past Two Weeks-

Over 30% of small business owners experienced a price increase for the goods or services that they purchased over the past two weeks (as of 2/9/25).

-

The high was 42.9% for businesses with 5-9 employees and the low was 31.8% for businesses with 50-99 employees.

-

The percentage is significantly higher than the percentages at year-end (12/31/24) but lower than the start of the survey (9/10/23).

-

-

Over 50% of small business owners experienced no change in prices paid.

-

The percentage ranged from a high of 67.6% (50-99 employees) to a low of 58.1% (10-19 employees).

-

-

Less than 2.5% of small business owners experienced a price decrease with the high at 2.1% (1-4 employees) to a low of 0.6% (50-99 employees).

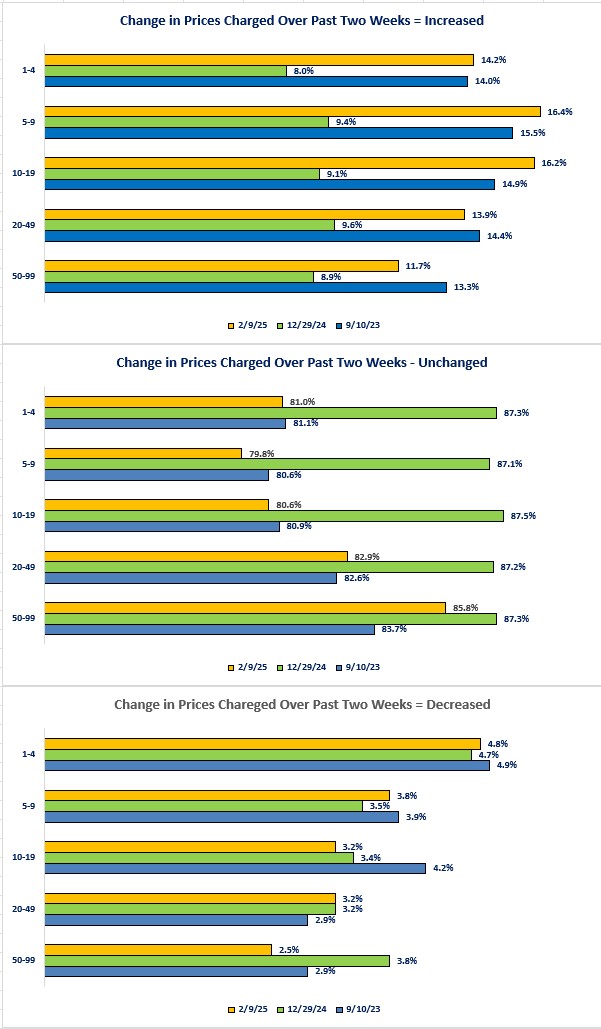

Now, let us examine what small business owners did regarding the price they charge for their product.

The survey question is: “In the last two weeks, how did the prices this business charges for its own goods or services change?”

Change in Prices Charged Over the Past Two Weeks-

Unfortunately, from a small business owner perspective, far fewer small businesses were able to pass through the price increases that the business was experiencing.

-

Less than 20% of small business owners increased their prices over the past two weeks with the high at 16.4% (5-9 employees) and a low at 11.7% (50-99 employees).

-

-

The vast majority of small business owners left prices unchanged with the high at 87.5% (10-19 employees) and the low at 87.1% (5-9 employees).

-

Less than 5% of small business owners dropped their prices with a high at 4.8% (1-4 employees) and a low at 2.5% (50-99 employees).

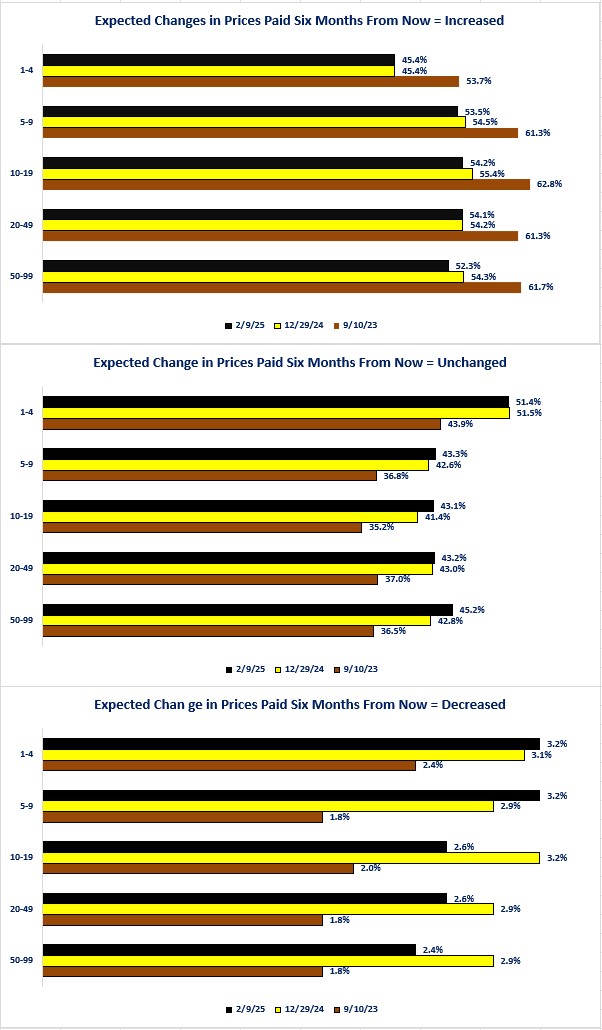

Tariff talk was prevalent during the first week of February but no actual new tariffs had been implemented. Given the fears and uncertainty over what will happen with prices if tariffs are implemented, let us see what small business owners' outlook was for prices in six months compared to 9/10/23 and 12/31/24.

The survey question is: “Six months from now, how do you think the prices this business pays for goods or services will have changed?”

Expected Changes in Prices Paid Six Months From Now-

On average, over 50% of small business owners expect that, six months from now, they will have to pay higher prices for the goods and services that they purchase.

-

The high was 54.2% (10-19 employees) and the low was 45.4% (1-4 employees)

-

-

More small business owners expect prices to rise in six months versus remaining unchanged,

-

The highest percentage for those expecting no change in prices was 51.4% (1-4 employees) and the low was 43.1% (5-9 employees).

-

-

The percentage expecting price decreases was less than 4% with the high at 3.2% (1-4 and 5-9 employees) and the low was 2.4% (50-99 employees).

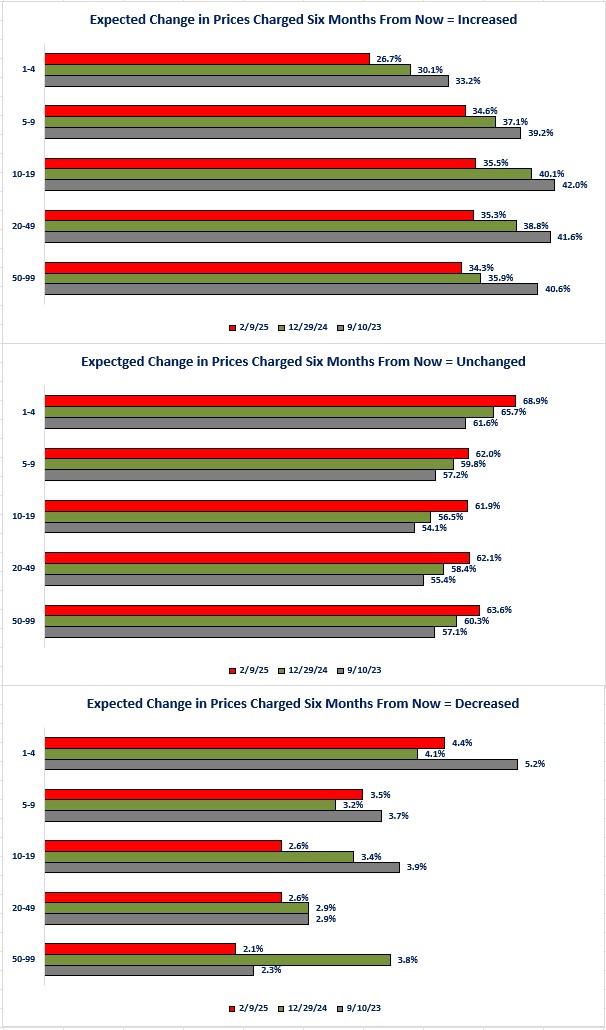

Finally, let us examine what changes, if there are any, small business owners are expecting to make regarding the prices they charge for their goods or services.

The survey question is: “Six months from now, how do you think the prices this business charges for its own goods or services will have changed?”

Expected Change in Prices Charged Six Months From Now-

When it comes to the percentage of small business owners who expect to raise the prices they charge their customers, the percentage is more than double what they are currently doing with prices.

-

The high is 35.5% (10-19 employees) and the low is 26.7% (1-4 employees). That compares to the current high at 16.4% and 11.7% as highlighted above.

-

Current percentages are well below levels as of 9/10/23.

-

-

On average, the percentage of small business owners expecting no change to their prices in six months is between 61.9% to 68.9%. This compares to the percentage of small business owners currently leaving prices unchanged in a range between 87.1% to 87.5%.

-

The percentage of small business owners expecting to lower prices in six months is lower than the percentage who have currently lowered prices.

-

The range is between 2.1% to 4.4% compared to current levels at 2.5% to 4.8%.

-

Closing thoughts.

- Size was not a clear factor for price changes as there was not a clear pattern for larger businesses being able to pay lower prices or charge higher prices compared to the smaller businesses.

-

The percentage of small business owners reporting price increase for the goods and services they buy declined significantly by year-end 2024 compared to 9/10/23. Since then prices paid are on the rise again for over 30% of small business owners surveyed.

- Perhaps suppliers were front running the anticipated tariffs they may have to pay and instituting price increases to start the year before the tariffs went into effect.

-

The survey results show that less than 20% of small business owners were able to raise their prices to help offset the price increases they suffered.

-

For those who suffered a price increase for the goods and services that they bought but did not raise the price for the goods and services that they sell, they experienced a decline in their profit margin, all else being equal.

-

-

Whether it is because of their belief that tariffs will cause prices to rise or other factors, most small business owners expect that in six months they will be paying higher prices for the goods and services that must to buy.

-

Unfortunately, a smaller percentage believe that they will be able to raise prices.

-

The relatively good news is that, even though most small business owners expect prices to increase in six months, the percentage is well below the percentage that expected price increases as of 9/10/23.

-

-

Prices paid versus prices received are a potential threat if small businesses cannot offset any increases in prices.

-

Passing through price increases is not the only strategy for maintaining profitability but it is the quickest.

-

Other strategies to increase productivity (i.e., doing more with less) take time and may be prohibitive if the cost to adopt is too high.

-

-

Since small businesses are a critical source of jobs and income creation, any threats to small business profitability and ultimately viability will affect economic growth.

-

I encourage everyone (small business owner, employee, and customer) to proactively communicate with your elected officials via text, email, phone call or letter, to give them specific feedback (negative, neutral, or positive) on how various fiscal policies will affect the small business you depend on.

-

Even though you may receive a “form letter” type of response, their staff still tracks all communications.

-

You may think your one voice will make no difference but if all people who are dependent on the success of small businesses proactively communicate to their elected officials, you will make the “voice” of small businesses heard.

-

Economic data.

|

Economic Data |

Time Period Reported |

Current Results |

Previous Results |

Comments |

|

3/17/25 |

|

|

||

|

Retail Sales Year-Over-Year Change |

February |

+3.1% |

+4.2% |

Weather as a factor as well as fear and uncertainty over fiscal policy. |

|

February |

+0.2% |

-1.2% |

A slight recovery from December's decline. |

|

February |

+0.3% |

-0.6% |

Marginally better growth in core retail sales. |

|

Business Inventories Monthly Change |

January |

+0.3% |

-0.2% |

Businesses were building inventories in January. |

|

Retail Inventories Monthly Change |

January |

+0.5% |

-0.1% |

Retailers were also building inventories. |

|

NAHB Housing Market Index |

March |

39 |

42 |

Builders reflected fears and uncertainty over the impact of tariffs for their decline in their outlook. |

|

3/18/25 |

|

|

||

|

Housing Starts Monthly Change |

February |

+11.2% |

-11.5% |

Housing starts rebounded from the weather induced decline of January. Housing starts are still down 2.9% from last February. |

|

Building Permits Monthly Change |

February |

-1.2% |

-0.6% |

Permits were down 0.2% for single family starts, up 5.3% for 2-4 unit multi-family and down -4.3% for 5 or more unit multi-family. |

|

Export Prices Year-Over-Year Change |

February |

+2.1% |

+2.7% |

The pace of price increases slowed in February compared to January. |

|

Import Prices Year-Over-Year Change |

February |

+2.0% |

+1.9% |

Strong demand for imports in front of potential tariffs drove the growth rate for import prices higher than January. |

|

Industrial Production Monthly Change |

February |

+0.7% |

+0.3% |

A solid increase in manufacturing production drove the increase.

|

|

February |

+0.9% |

+0.1% |

Motor vehicles and parts production drove the increase. |

|

3/19/25 |

|

|

||

|

MBA Mortgage Applications Weekly Change |

3/14/25 |

-6.2% |

+11.2% |

The decline in applications was all from a decline in refinancing activity. |

|

3/14/25 |

0.0% |

+7.0% |

Purchase activity was flat for last week. |

|

3/14/24 |

-12.8% |

+16.2% |

After two weeks of strong activity, refinancing activity dropped last week. |

|

3/14/25 |

6.72% |

6.67% |

Mortgage rates moved slightly higher last week. |

|

3/20/25 |

|

|

||

|

Initial Jobless Claims |

3/15/25 |

223,000 |

221,000 |

Filings for initial unemployment benefits continues to remain fairly stable. |

|

Continuing Jobless Claims |

3/8/25 |

1,892,000 |

1,859,000 |

More people are finding it harder to get a new job once they become unemployed. |

|

Philadelphia Federal Reserve Manufacturing Index |

March |

+12.5 |

+18.1 |

The two concerning parts about the results are that the sub-index for business conditions suffered a substantial decline (from 27.8 to 5.6) and the price sub-index rose from 40.5 to 48.3. That begins to look like stagflation. |

|

Existing Home Sales Monthly Change |

February |

+4.2% |

-4.7% |

Sales rebounded in February after a weather induced decline in January. |

|

Leading Index Monthly Change |

February |

-0.3% |

-0.2% |

The index deteriorated from January's results. |

|

3/21/25 |

|

|

||

|

No data released |

|

|

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.