With the current uncertainty over what the extent of deportation will be for undocumented immigrants, I thought it would be worthwhile to focus on a different part of migration. That is the migration of US citizens from one state to another. Domestic migration is a potential source of labor and tax revenue for states with net in-migration but a risk to states experiencing out-migration. The difference with domestic migration is that it is a zero-sum situation. By definition, domestic migration means that someone is leaving one state to move to another. U-Haul has released the results of its annual report on the number of people using U-Haul to move from one state to another. As a result, this week's Perspectives section will examine the data and provide insights into what the data reveals.

Soundbite.

Understanding domestic migration patterns within the US is important for states to successfully manage growth or reduction in its population, labor force and tax revenue.

-

Currently the pattern shows people moving away from the East Coast (and California) and moving to the south (Southeast and Southwest).

-

Idaho, Washington and Utah are the top Western states experiencing in-migration.

-

When viewed on a net basis (people moving to a state versus people moving out of the state) the top and bottom ten rankings change slightly and Arizona, Texas and Washington drop out of the top ten (but remain in the top twenty).

Understanding domestic migration patterns is important for the long-term success of a state.

-

Those states that proactively plan for and manage domestic migration (both in and out) are more likely to manage changes successfully compared to those that are reactive and don't respond until the changes have already hit.

Disclosures.

The data is from U-Haul based on their one-way rentals.

-

The data covers over 2.5 million one-way truck, trailer and U-Box portable moving container rentals.

-

The data is for 2024.

Observations.

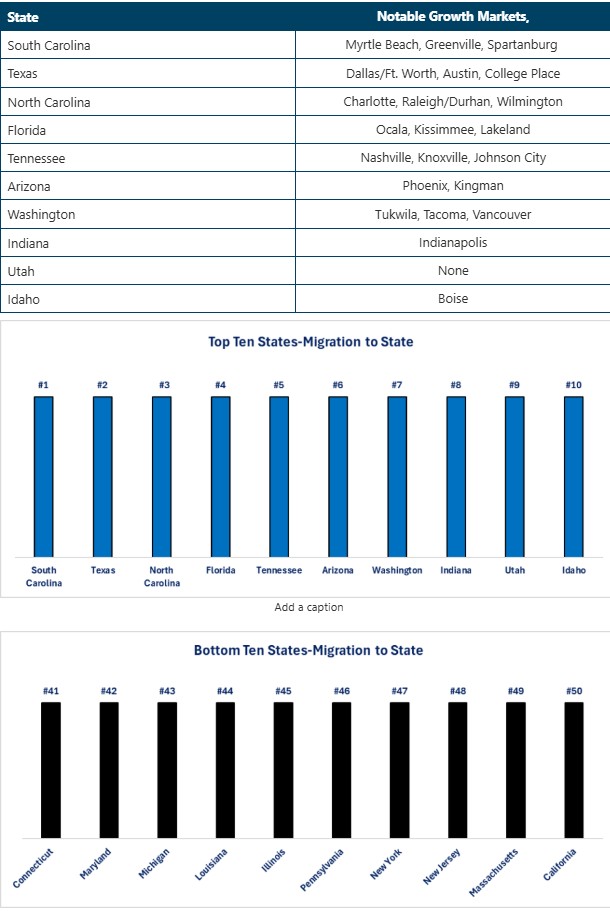

Let us start by examining the top ten states for migration to the state.

-

The southern half of the US has the top six states for people moving to the state.

-

The majority of the states in the bottom ten are on the East Coast.

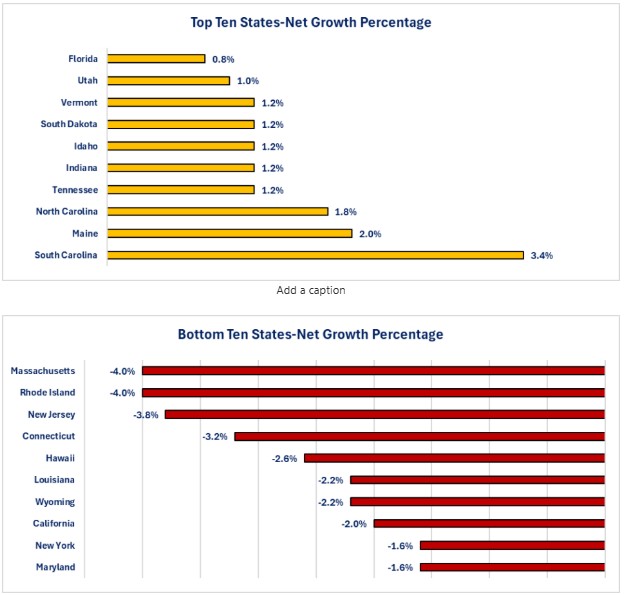

Tracking people moving into a state is one way to look at migration patterns. The problem is that it does not capture how many people are leaving a state since people moving to a state are leaving another state. U-Haul provides a growth index that shows the net growth (arrivals versus departures). Let us examine what that data shows us.

-

The rankings shift slightly for the top ten but the composition changes too.

-

Arizona, Texas and Washington drop out of the top ten while Maine, South Dakota and Vermont move into the top ten.

-

This tells us that although Arizona, Texas and Washington are seeing a lot of people moving to the state, they are also losing people.

-

Arizona drops to #13, Texas to #14 and Washington to #15 when viewing net gains.

-

-

-

The rankings also changed for the bottom ten.

-

Illinois, Michigan and Pennsylvania dropped out of the bottom ten and Hawaii, Rhode Island and Wyoming moved into the bottom ten.

-

All of the bottom ten had net losses and there was a total of fifteen states that had net losses.

-

Closing thoughts.

- There can be a wide range of reasons why someone is moving to or from a state. Some reasons (but not all) include:

-

-

Cost of living

-

Housing affordability

-

Quality of life

-

Quality of schools

-

Quality of medical care

-

Family (wanting to be close to or far away from family)

-

Jobs (opportunities or losses)

-

Weather

-

Political or religious beliefs

-

-

Migration patterns are important for a state as they affect services offered and needed.

-

Net migration out of a state risks an unbudgeted loss in revenue and tax base.

-

If the pattern continues, the risk is that the state does not have sufficient revenue to maintain infrastructure and services provided to its citizens. That creates the risk that the outmigration will continue and may accelerate.

-

-

Net migration into a state or city may be a benefit as long as the people moving into the state are bringing jobs with them or filling job openings.

-

The risk for a state is that people moving to a state that do not plan to work will create an increased demand for goods and services without filling job openings needed to increase those goods and services.

-

Another risk is that the increased population starts to stress the infrastructure and demand for goods and services.

-

If the population will not support taxes to pay for maintaining the quality of the infrastructure (i.e. support new roads, schools, etc.) then some of the reasons for moving to a state deteriorate (i.e. cost of living, housing affordability and quality of life).

-

-

Net in-migration may also create problems if the beliefs of the people moving to the state do not match what exists in the state (i.e., political, religious, environmental and business beliefs).

-

-

Understanding domestic migration patterns is important for the long-term success of a state or city.

-

Those states that proactively plan for and manage domestic migration (both in and out) are more likely to manage changes compared to those that are reactive and don't respond until the changes have already hit.

-

Economic data.

|

Economic Data |

Time Period Covered |

Current Results |

Previous Results |

Comments |

|

1/22/25 |

|

|

||

|

MBA Mortgage Applications Weekly Change |

1/14/25 |

+0.1% |

+33.3% |

Applications were essentially unchanged after the surge last week. |

|

1/17/25 |

+0.6% |

+26.9% |

After the surge last week, buyers appeared to be taking a break this week. |

|

1/17/25 |

-2.9% |

+43.5% |

Last week's surge appears to be people panicking to lock in rates over fears that mortgage rates were going to rise more. Stable rates this week put an end to that panic. |

|

1/17/25 |

7.02% |

7.09% |

Not much change from last week. |

|

Leading Index |

December |

-0.1% |

+0.4% |

After breaking its streak of negative results last month, the index posted another negative result in December. |

|

1/23/25 |

|

|

||

|

Initial Jobless Claims Weekly Change |

1/18/25 |

223,000 |

217,000 |

The increase was driven by a surge in claims in California due to the wildfires. |

|

Continuing Jobless Claims Weekly Change |

1/11/25 |

1,899,000 |

1,853,000 |

Continuing claims increased 43,000. |

|

Kansas City Federal Reserve Manufacturing Activity Index |

January |

-9 |

-6 |

Manufacturing activity in the Kansas City region declined further. |

|

B1/24/25 |

|

|

||

|

S&P-Global Composite PMI |

January |

52.4 |

55.4 |

The decline was all due to a large decline in service sector orders. |

|

January |

50.1 |

49.4 |

The manufacturing sector improved and just barely managed to reach a positive level (50 is considered neutral). |

|

January |

52.8 |

56.8 |

The service sector has been a source of strength, so the decline is surprising. |

|

University of Michigan Consumer Sentiment Index |

January |

71.1 |

74.0 |

The composite index fell as sentiment towards the future fell sharply. |

|

January |

74.0 |

75.1 |

After a surge up since the elections, consumers became less confident about their current situation in January. |

|

January |

69.3 |

73.3 |

Consumers’ outlook about the future has deteriorated dramatically since the end of the elections. The start of a new year did nothing to improve the negative view towards the future. |

|

Existing Home Sales Monthly Change |

December |

2.2% |

+4.8% |

The pace of sales slowed but remained positive. |

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.