Economic Summary

The “hard” economic data continued to depict a steady picture for the nation's economy.

Interest Rates:

The Federal Reserve left the overnight borrowing rate unchanged at the conclusion of its monetary policy meeting. Mortgage rates (30-year fixed rate) remained virtually unchanged last week at 6.84% compared to 6.89% the week before.

Jobs:

The jobs markets also showed steady results as initial jobless claims fell by 13,000 and remain within the 200,000 to 250,000 range. Continuing claims fell 29,000.

International Trade:

The trade deficit data confirmed the information that we learned from last week's GDP report: imports surged in advance of April's tariff announcement. Imports rose $18 billion in March while exports were unchanged. We will start to get April data releases throughout May which will give us better insight into the impacts of the tariff that were implemented in April. On the tariff tax front, on Wednesday President Trump announced that an agreement has been reach for a trade deal with the UK. No details have been released but preliminary reports are that it is limited to technology and AI products.

Perspectives

States that want to attract new businesses or keep existing businesses need to ensure that they have a labor pool to meet the needs of the businesses. There are multiple factors that can attract or retain people to a state. A few (but not all) of the major factors include housing affordability, quality of education and healthcare, and public safety. Today's Perspectives section examines one of those factors: housing affordability.

Commentary

Housing affordability is currently a major issue for much of the US. For many people, deciding whether to accept a job offer may come down to whether they can afford to live in the state where the job is located. Housing is a critical factor in the cost of living in a state. This is true both for young adults who want to get married and start a family as well as existing households who have an opportunity or desire to move.

When it comes to buying a house, the average buyer is going to utilize one of the government programs offered by mortgage lenders. To qualify for those loans, prospective buyers must meet the Front-End Ratio test. This is the ratio of total housing related expenses (i.e., mortgage payment, property taxes, and homeowners' insurance) as a percentage of gross monthly income. For FNMA and FHLMC that ratio cannot exceed 28%. USDA loans can go as high as 29% and FHA loans can go as high as 33%. There are also some first-time home buyer programs than can raise the ratio as high as 35%.

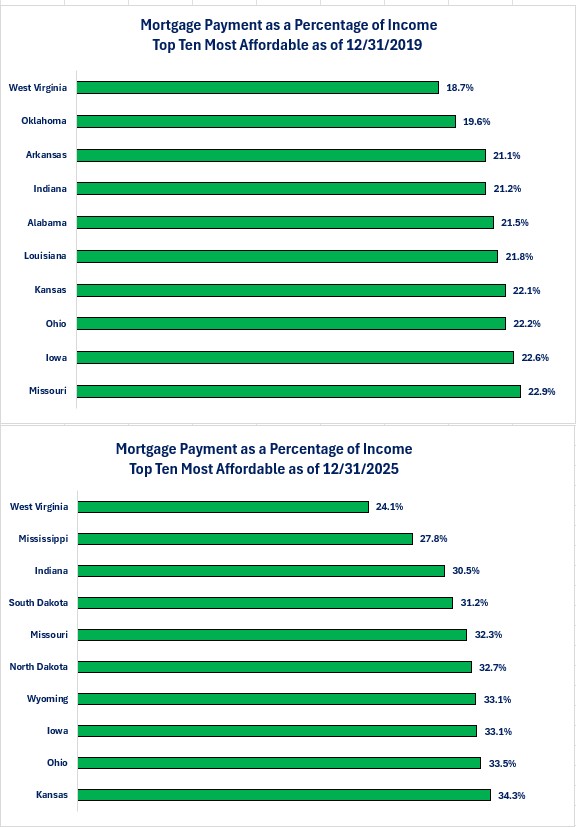

Let us examine what the ratio looked like at the end of 2019 compared to 2024. To calculate the mortgage payment, I assumed a 10% down payment and the mortgage rate at the end of the year. The results are sobering.

-

At the end of 2019, 26 states (52%) had an average Front-End Ratio that was 28% or less.

-

By the end of 2024, only 2 states (4%) had an average ratio at or below 28%.

Using the 33% ratio for FHA loans saw improvement but the trend was the same.

-

At the end of 2019, 38 states (76%) had the ratio at or below 33%.

-

By the end of 2024, only 6 states (12%) had the ratio at or below 33%.

The first graph shows the top ten states for affordability with 2019 at the top part of the graph and 2024 at the bottom. You can see in 2019 all of the top ten states had an average Front-End Ratio below 28% while only West Virginia and Mississippi met the criteria at the end of 2024. There was also a slight change of constituents as Alabama, Arkansas, Oklahoma, and Louisiana fell out of the top ten most affordable and North Dakota, South Dakota, Mississippi, and Wyoming took their place.

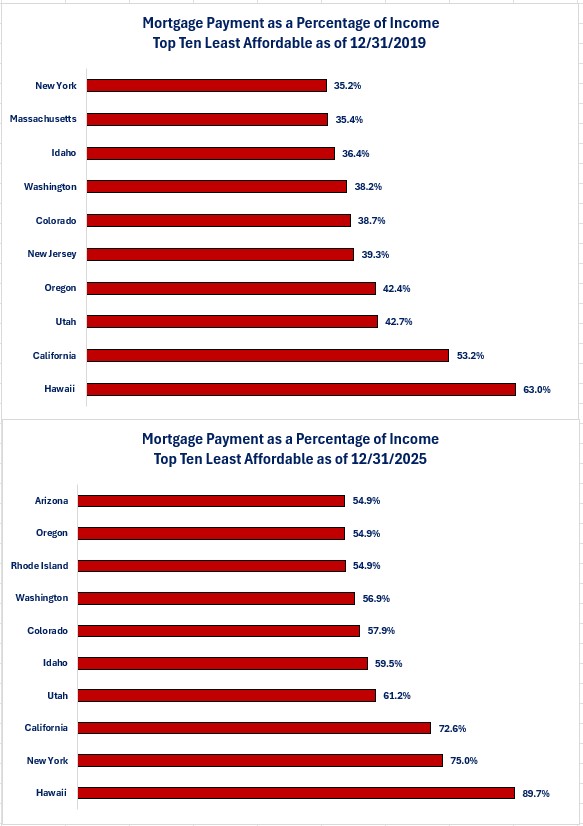

The next graph shows the ten least affordable states when measured by the Front-End Ratio. New York experienced the worst deterioration in its Front-End Ratio as it went from 35.3% in 2019 to 75.0% in 2024. Massachusetts and New Jersey fell out of the top ten least affordable states while Arizona and Rhode Island took their place. Unfortunately, for the three states where Washington Trust Bank has offices, they are all in the top ten least affordable group for both 2019 and 2024. Idaho experienced the worst deterioration of those three states as its ratio went from 36.4% in 2019 to 59.3% in 2024. This reflected the in-migration of people moving to Idaho from California, Oregon, and Washington. They sold their homes in high priced states and drove up prices in Idaho as they were relatively price insensitive given the difference in price between the two states. The increased demand for homes was not met with enough increased supply to prevent price increases.

The results shown were for one income. To be able to buy a house, it would take two incomes to get the Front-End Ratio below the maximum level. Assuming the two people (spouse or partner) both earned the personal income level for their state, a couple would be able to meet the 28% level in all but seven states as of the end of 2024. All but five states would meet the 29% level using two incomes and all, but three states would meet the 33% level. There a several problems relying on two incomes to buy a house.

-

Using so much of your income to make a mortgage payment leaves far less room for other expenses, especially daycare or student loan payments.

-

Large mortgage payments as a percentage of income may also leave little room for maintaining the house. This creates a problem if you want or need to sell the house in the future.

-

If one of the two incomes was impacted either through a reduction in pay or the loss of the income (job loss or death) making the mortgage payment would probably require major cuts in other spending categories.

Unaffordable housing also creates a negative ripple effect.

-

Lack of affordable housing creates extra demand for rental units (multi-family or single family). The increased demand can then lead to higher rental prices. Higher rental prices then make it harder for a couple to save a down payment for a house.

There is no easy answer for solving the affordability problem. The answer to address unaffordable housing is simple in concept but extremely complex in reality. Conceptually, the solution is to either lower the cost of houses or pay higher wages. If only it were that easy in the real world.

Housing affordability is a problem that has no easy solution but needs serious attention at both the national and local level. Ultimately, If the US wants to execute an “America First” strategy, the affordable housing issue needs to be addressed. States looking to attract more businesses to their state as part of an “America First” strategy need to proactively bring all stakeholders together to address the housing affordability issue.

Ultimately, the adage will most likely remain true: out of crisis comes opportunity. Those states that will prosper will most likely be those that bring the housing stakeholders together and foster cooperation to identify the opportunities and find solutions.

Disclosures

-

Personal income data is from the Bureau of Economic Analysis.

-

The average home price is from Zillow.

-

The average property tax is from Lincoln Institute of Land Policy.

-

The average homeowners' insurance is from the National Association of Insurance Commissioners.

-

The year-end mortgage rates were from the Mortgage Bankers Association.

-

4.06% in 2019

-

6.97% in 2024

-

Steve is the Economist for Washington Trust Bank and holds a Chartered Financial Analyst® designation with over 40 years of economic and financial markets experience.

Throughout the Pacific Northwest, Steve is a well-known speaker on the economic conditions and the world financial markets. He also actively participates on committees within the bank to help design strategies and policies related to bank-owned investments.